Why User Acquisition Costs Are an Important Metric For Your Business

In every branch of industry, it is important to establish a wide customer base in order to be successful. To get there, you have to invest all your time, effort and sufficient budget into optimizing your user acquisition. In this article, we will mainly focus on the financial side and explain how to calculate your user acquisition costs. This is a necessary step to measure the efficiency and profit of your business.

Average customer acquisition costs by industry © ayeT-Studios

The essential, and probably most difficult, part of user acquisition is reaching out to the right group of users! Basically, you have to attract interested and loyal users, who want to engage with your product, more precisely your app, for a long time. How do you accomplish that and does it affect your user acquisition costs?

What Are User Acquisition Costs Exactly?

Before we can dig deeper into any calculations, we want to give you a short definition of customer, and more specifically user acquisition costs in the case of mobile apps.

Customer acquisition costs (CAC) portray the estimated costs for every new user you acquire for your business. The CAC is an important metric while figuring out if your marketing and user acquisition strategies are effective.

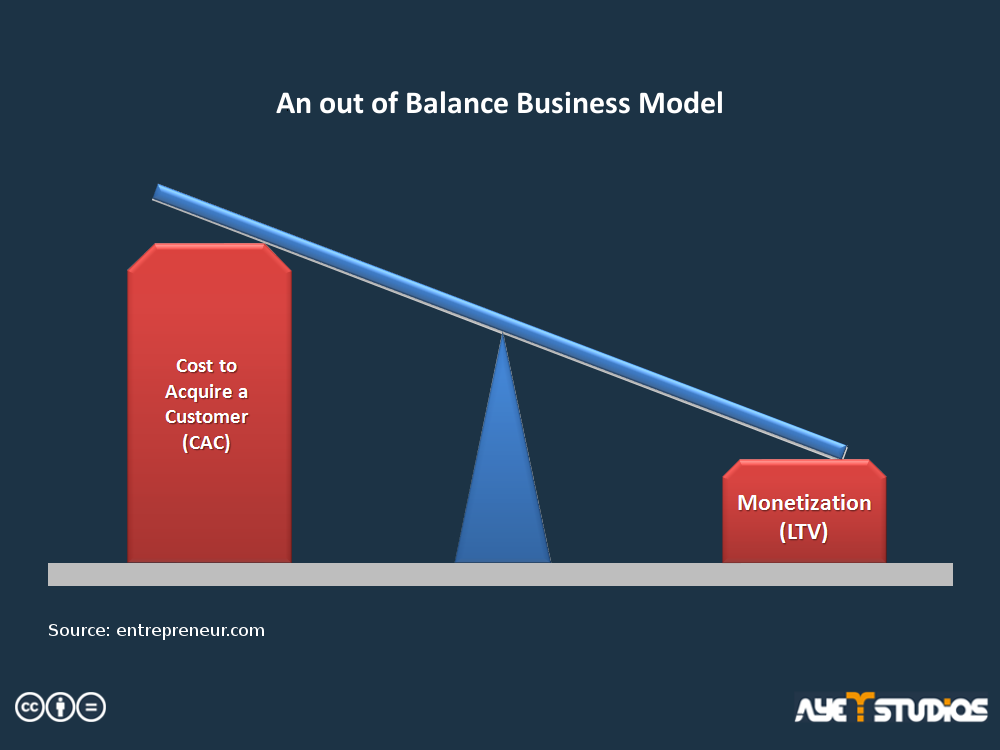

In detail, you can explore the value and worth of every single user to your company. By comparing your user acquisition costs to their lifetime value (CLTV), you can calculate how much you can spend on a potential customer and finally your return on investment (ROI). If your CAC is higher than your CLTV or your ROI, it is time to fix your acquisition strategy immediately!

Click here to learn more about finding the best user acquisition strategy.

Example of an unbalanced CAC to CLTV ratio © ayeT-Studios

How You Can Calculate Your User Acquisition Costs

To calculate your user acquisition costs, you have to determine all the resources necessary to acquire one single new customer first. These resources portray every effort you have to invest, from reaching potential users to converting them into active customers.

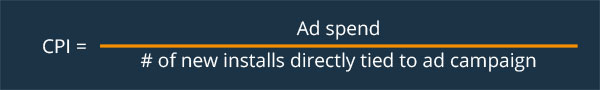

Cost Per Install

When calculating your user acquisition costs for mobile apps, this metric correlates with the general understanding of CAC. Since CPI, or cost per install, portrays the costs for ads that trigger installs of your app, this can be compared to the traditional costs of customer acquisition in e-commerce.

However, how much you actually have to pay depends on what kind of ad format you use. Thus, you probably have to invest much more in non-incent banner ads than in incent campaigns through an offerwall.

CAC

In general, consider the following expenses of your own marketing department when calculating your customer acquisition costs:

- Employee costs & salaries

- Paid advertising & agency fees

- Your own advertising campaigns

- Digital marketing: maintenance of your website and various social media channels

- Direct marketing: e.g. mail or email campaigns

- Print media & company publications

- CRM & gifts or discounts for your customers

- Software licenses

- Events & sponsorships

Try to figure out the amount of each matter of expense as precisely as possible! Your entire calculation will be much more precise.

The general formula for calculating your customer acquisition costs can be applied to any industry. Here, you have to sum up all marketing expenses and divide it by the number of users you managed to acquire in a specific period of time.

However, you aren’t finished just yet! Now, you have to define the lifetime value (LTV) of your users, or in other words your ability to monetize a customer.

Customer Lifetime Value

The customer lifetime value predicts the amount of financial profit and revenue your business generates through any acquired customer. In general, it portrays the worth of your relationship with this customer and refers to his entire lifetime at your company.

Furthermore, the more satisfied users are with your service, the higher their lifetime value. Therefore, you should focus your efforts on providing a great experience for your customers. Depending on what your products and services are all about, you should set relevant Key Performance Indicators (KPIs).

For instance, if you have an e-commerce business, you should concentrate on optimizing and accelerating the buying process. Don’t prolong these sessions needlessly since users might abort the purchase – which results in losing a potential customer.

In other fields, like app development, your goal should be to create a flawless product to attract and engage users for longer. After all, you’ll want to maximize retention, session duration and total usage for every user acquired.

Overall, the customer lifetime value depends on these three factors:

- Monetization – The amount a certain customer contributes to the revenue of your business.

- Retention – How often a customer returns to your business.

- Virality – The value of additional users a customer refers to your services and products.

Now, before you can calculate your CLTV, there are a few more metrics you have to gather first.

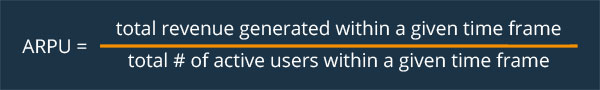

Average Revenue Per User

The ARPU reflects the average revenue a certain active customer contributes to your company in a specific period. You can use the following formula:

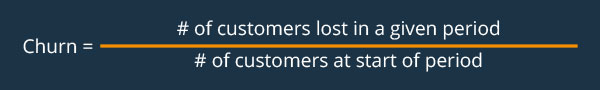

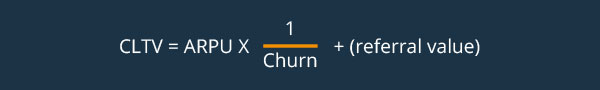

Churn Rate

The churn rate represents the number of users who no longer engage with your app. Therefore, it indicates the satisfaction of your users with your company. Use this formula to calculate your churn rate:

With these additional calculations, you are finally able to determine your customer lifetime value:

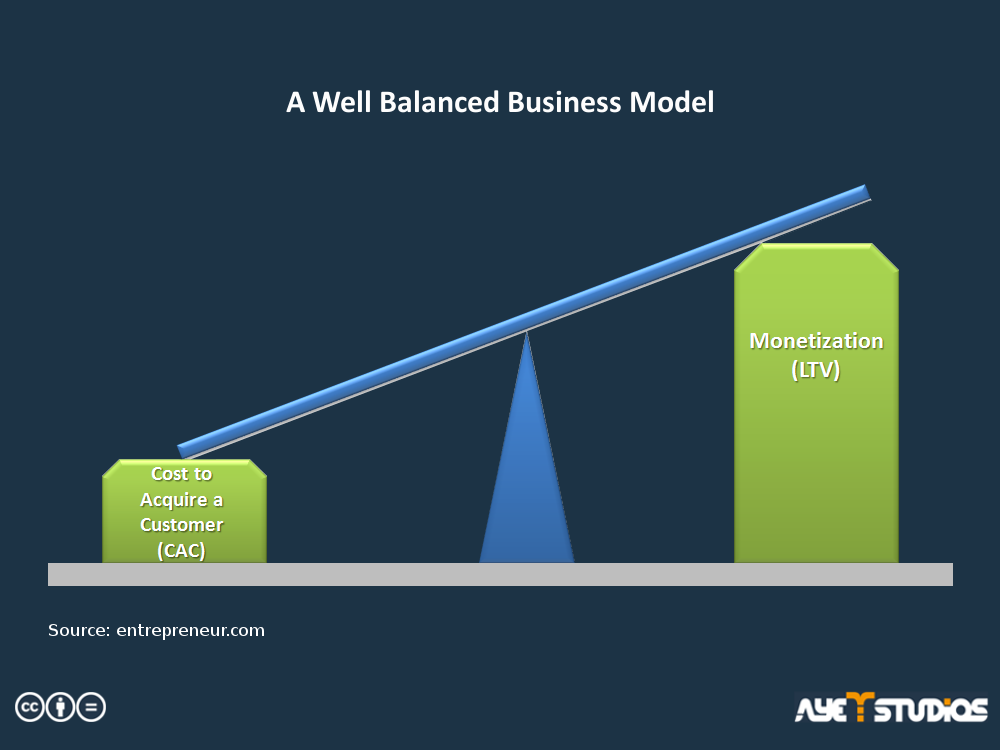

As a last step, you have to contrast your customer acquisition costs to your customer lifetime value. If the former is higher than your LTV, then your business is not beneficial. In fact, it indicates that you are investing too much in acquiring users without the ability to make any profit in return. In the end, this might lead you and your company to failure.

Therefore, keep in mind to never spend more than you’re able to gain with your active users!

Example of a well balanced CAC to CLTV ratio © ayeT-Studios

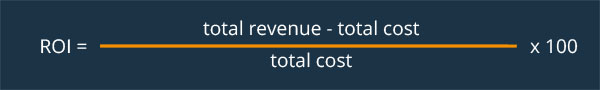

Return On Investment

The return on investment, or ROI, helps you measure your profit or loss relative to your budget spend. Hence, you can figure out how beneficial your business really is and compare the efficiency of different investments. Don’t forget to include all further costs of your business as well – like rent, HR, infrastructure, etc!

Like CLTV, your return on investment should always be higher than your customer acquisition costs!

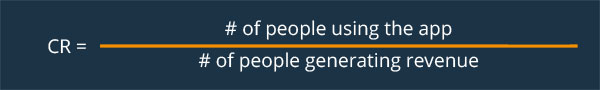

Conversion Rate

The conversion rate shows the percentage of users who take a desired action and therefore convert into active customers. These actions can vary from business to business, depending on which products and services are offered. Typical actions are downloading content, signing up for a newsletter, joining a community, getting in contact with a website owner or clicking on display ads.

Additionally, the conversion rate portrays the value of each individual user to your company.

When calculating your user acquisition costs for apps, there are two types of conversions you should mainly have an eye on:

- Install / Active Users: Here, you can calculate how many users installed your app based on your mobile user acquisition campaign and converted into active customers by taking a predefined action.

- Active Users / User Generated Revenue: This helps you calculate the amount of users that actively engage with your app and take actions to generate revenue, for example through in-app-purchases.

How to Reduce Your User Acquisition Costs

After you formed an overall perspective of what you’re spending on acquiring new users, here are some tips to reduce your user acquisition costs. As we learned by now, this is necessary if you want to make a profit with your business.

1. Raise Your Expectations!

Don’t make the mistake of setting your expected user acquisition costs too low! When calculating before you finished the development stage of your company, you have to estimate the result. At this point, you should consider a few challenges that might arise:

- Exactly know your potentially effective acquisition channels!

- Expect time delays that might affect your costs!

- Adjust your numbers according to real-life experiences!

Because of these possible challenges, you should double, or even triple, your calculated costs to prevent any misestimating.

2. Know Who You Should Be Targeting!

To avoid wasting your resources for ineffective marketing channels, define a target audience by creating a specific persona. Then, adapt all your efforts and investments according to the characteristics and interests of this persona.

3. Leverage Your USP!

Give users a good reason to buy your product! The USP, or unique selling point, defines a specific feature of your product that makes it stand out in comparison to your competition.

Emphasize it for your potential customers and focus most of your branding strategy on this information. If you don’t have a USP, users won’t see any advantage in buying your product of all things.

4. Improve Your Content Marketing!

By implementing so-called long-tail keywords into your website content, you automatically improve the chance of generating organic traffic. Since users generally search for longer and more specific keywords if they want to purchase something, they are more likely to find your content!

5. Don’t Just Acquire – Retarget As Well!

Most of the time, it’s much more expensive to acquire a new customer than to keep an existing one. If you haven’t establish a customer base just yet, your answer is retargeting. Basically, all you have to do is get in contact and communicate with your potential customers. This is someone who visited your website but didn’t make a purchase.

6. And Last but not Least: Testing!

All these tips won’t have any lasting effect if you don’t know which changes are actually effective. You have to test any content, like your landing pages, home pages or marketing funnels, after modifying them. Even more ideas of possible improvements will arise and you will realize which of your changes work best.

Therefore, doing split or A/B tests regularly is a qualified method to lower your user acquisition costs.

Conclusion

To answer the question we asked at the beginning: Targeting the right users does indeed affect your user acquisition costs! For one, acquiring active, long-term customers plays a major role in the success of your business regarding CLTV. Furthermore, by identifying your most rewarding target audience straightaway, you can even reduce your CAC in the long run.

That’s why you have to calculate and observe your user acquisition costs constantly in order to optimize your strategy.